I’ve heard fundraising veteran and founder of Fundable.com and Startups.com Wil Schroter comment, “There’s not a lot of ‘fun’ in funding.” He likely means that the task of fundraising for a founder is a full-time job, can be a grind, and has extreme implications on your main priority: building the business.

Now, you’re probably thinking, “Isn’t fundraising part of building the business?” or, “Don’t you need funding to build the business?” Therein lies the classic chicken-and-egg problem! The answer to both questions is yes and no.

You do need resources to build the business, but your primary goal isn’t to get funded, it’s to build a high-growth business that:

- Solves a particular pain for your customer through a business model that adds value to your customer’s business and profitably rewards your company for providing the service, and

- Enables your shareholders (you, your team, and if you’ve taken on investors, your other shareholders) to receive a return on their investment that is higher than their cost of capital.

I often see startup founders make getting funded their sole focus when what they should be doing more of is deepening their understanding of the problem. To do that, founders should engage as many early-stage adopters as possible who have pain, are motivated to make it go away, and are willing to invest time to help you tailor your solution into one they’d commit to using and paying for because it solves their pain.

Successful high-growth companies often need capital to fuel growth, so startup funding is usually required to pour gas on fire (i.e., hire more staff to build, sell, and service customers). In other cases, seeking investment from the beginning is a fundamental necessity. This is often the case in underrepresented communities, where founders may not have access to the resources needed to launch successfully. They also may not have friends or family with the financial capacity to loan or invest the initial capital.

When this is the case, the only option left for an entrepreneur is to find like-minded individuals elsewhere in the startup community to support their vision. We’ll discuss the role advisors play in this scenario later in this post, but first, let’s walk through the startup financing cycle.

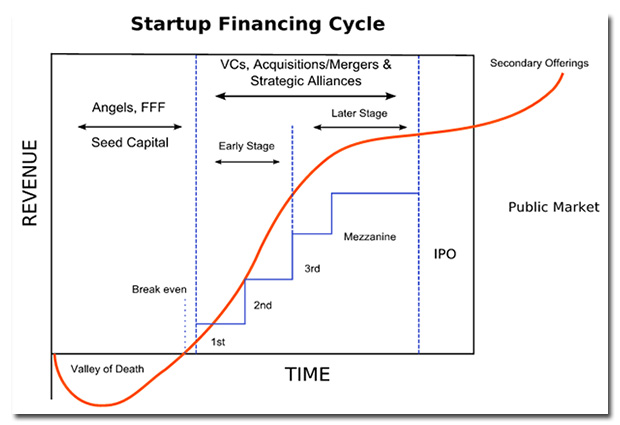

The Startup Financing Cycle

Whether you need funding immediately or you’re waiting for the right time to find the perfect investor to fuel your growth, the startup funding process will be a distraction from your core business. Fundraising steals time that could be spent focusing on the customer and it is emotionally exhausting for the fundraiser (usually the founder), so it’s critically important that founders understand the nitty-gritty of each funding stage so they can maximize their time, energy, and effort.

[IMAGE CREDIT: Wikipedia via ZDNet]

Although the stage names and exactly what happens during each stage might vary depending on risk-tolerance and perspectives in different geographic areas, domestic and international, here’s a basic overview of what you can expect at each stage of fundraising:

Pre-Seed Stage – The earliest stage, often overlooked, where a founder may be working on his or her own or with a very small group to establish a prototype or proof-of-concept. Funding at this level may come from personal finances, credit cards, friends and family, and/or maybe an angel investor or incubator.

Some call this stage the 3F’s – family, friends, and fools. It’s a little tongue-in-cheek about the fools because sometimes when you meet someone as passionate as you, they may know it’s a long shot. But because they love your passion for the problem, they may be willing to walk in with “eyes wide open.” In this stage, investors are betting on your team, your understanding of the problem, and your vision for solving your customer’s pain.

Seed Stage ($500K-2M) – Many enterprises start here. If you’ve been following earlier StartupHeat posts on The Mindful Startup Formula, the seed stage is where you’ll progress from idea to MVP, i.e., product development and problem-solution fit. Sources range from friends/family and crowdfunding to incubators and angel investors, to venture capital firms specializing in early-stage startup funding.

Many startups fold in the seed stage if they aren’t able to gain revenue traction. In this stage, investors are betting on everything in the pre-seed stage, but your ability to show “proof of opportunity” becomes critical.

Today’s startups live in a rather flattened startup world, meaning they can achieve so much more with so much less compared to 20 years ago. So, investors want to see that you’ve achieved some traction – with critical areas of the business:

- A working product

- Paying customers

- A solid team who’s been there before, and

- Advisors who can add significant value).

They want signal!

Venture Capital Funding – During “Series” stages, funding is usually led by venture capital firms. In the Series A round, investment most often is led by a single firm and will fall somewhere between $2M and $15M, an infusion of capital that will significantly raise an enterprise’s valuation.

According to Startups.com, because VC investments are at a much higher level than the seed stage, “investors are going to want more substance than they required for the seed funding before they commit. It’s no longer acceptable to have a great idea – the founder has to be able to prove that the great idea will make a great company.”

And according to data analytics firm CB Insights, just 46 percent of Series A-funded companies raise another round. In other words, this stage is usually the end of the road for most early-stage companies.

A company that reaches the Series B round has usually achieved product-market fit, is ready to scale and needs money to expand its customer base, marketing efforts, and its team in order to serve more customers. Funding at this stage ranges from $5M to $50M and also comes from VC sources, often the same investors who provided Series A funding.

Series C, D & E investments (or Growth Equity) is usually the last round of venture funding a company will take as it prepares for mezzanine capital, an initial public offering (IPO), or acquisition. Companies at this stage have already proven themselves in the market, are looking to expand geographically into new markets, and are very low-risk bets for late-stage investors.

As of this writing, capital is cheap, and some (successful) founders are starting to accelerate alternative forms of capital to reduce dilution. Very smart if you are one of the few who can pull it off!

Mezzanine – According to Startups.com, mezzanine financing is a startup funding stage “that’s all about preparing the startup for that final push to an exit…the goal of mezzanine financing is to get the startup to exit more quickly, so for companies that are close but just need an extra boost before their IPO or acquisition, this type of financing can be extremely valuable.”

Providing a hybrid of loan and equity financing, mezzanine investors are paid back after IPO or acquisition and often ask higher interest than a traditional bank loan – usually 12-20 percent.

IPO – Often the final stage of the startup funding process is going through an initial public offering of stock, i.e., “going public” and being listed on a stock exchange. Hai Truong with TechDay says, “This is not the end goal for all startups. However, if you have raised money through each of the preceding stages, going public is an option to expand [your business] further.”

Additional Fundraising Resources for Your Startup

When seeking sources for early funding, a founder often will benefit by connecting with a really good advisor. Advisors can even be sources for funding, either directly or indirectly through their own connections to funders. If the advisor can’t help with fundraising, it doesn’t mean they’re not worthy, but you do want advisors that can be helpful in navigating the process.

Advisors come in all shapes and styles, and many are good at what they do, but some are faking it until they make it, and you’ll want to do your homework. When an advisor has ALL the answers about EVERYTHING, that’s usually a sign to really dig deeper by calling references and obtaining proof of value. And you can never get too many advisors – rarely will you get them all to agree.

In our previous post, we discussed separating the signal from the noise. Throughout the fundraising process, from pre-seed to IPO, it’s just as critical to use those signal deciphering tools to find the signal that helps you prioritize your efforts and, ultimately, be successful.

In the next edition of StartupHeat, I’ll share with you my reasons why I joined the early-stage venture capital firm, Mercury Fund. Until then, stay curious, focus on the signal, and make mindful decisions on your journey to success!